Trusts & Estates

Plan Your Future Today:

Trusted Will and Trust Services

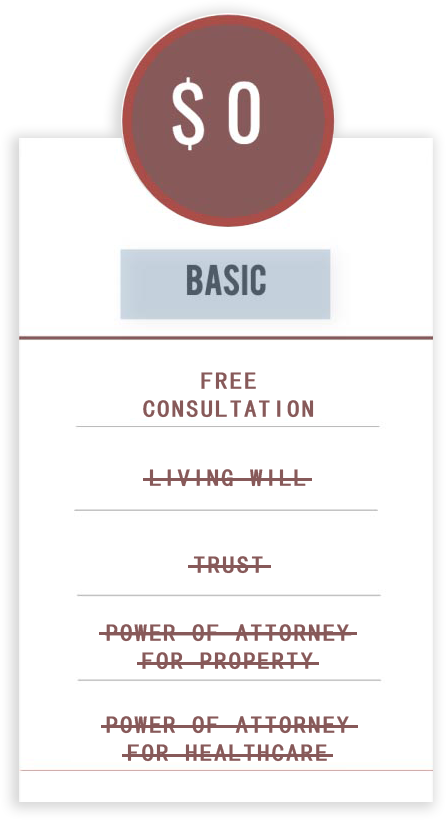

Out Trusts & Estates Group is dedicated to assisting individuals and families in attaining both their personal and business objectives.

We accomplish this by providing services such as gift planning, estate planning, business succession planning, and charitable planning.

Question – Answer

Frequently asked Questions

What’s included in the estate plan and how often should I review it?

Estate planning is a critical responsibility ensuring the proper management of your assets and the welfare of your loved ones after your passing. By collaborating with an attorney specializing in estate planning, you can develop a thorough plan to safeguard your interests and alleviate potential burdens on your family.

The standard estate plan package typically includes:

- Will: At the core of estate planning lies the will, a legal document specifying asset distribution upon your death and appointing guardians for minor children. Without a will, the state may allocate your assets contrary to your wishes.

- Trust: A trust is another essential tool in estate planning, serving to hold and manage assets for designated beneficiaries. Trusts offer various benefits, including tax advantages, protection from creditors, and private wealth transfer outside of the public probate process.

- Durable Power of Attorney: This document empowers someone to make financial decisions on your behalf should you become incapacitated, such as bill payment and investment management.

- Healthcare Power of Attorney: Similar to a durable power of attorney, this designation allows someone to make medical decisions for you if you are unable to do so, ensuring your healthcare preferences are followed.

Regarding review frequency:

Life circumstances evolve, necessitating periodic estate plan reassessment. Major events like marriage, divorce, childbirth, or property acquisition can significantly impact your estate planning needs. Generally, consulting with your lawyer every three to five years is advisable. However, significant life changes or legal modifications may prompt an earlier review.

In conclusion, estate planning is an ongoing process rather than a one-time task. By collaborating with a knowledgeable attorney and regularly updating your plan, you can ensure your assets are distributed according to your wishes and your family is adequately cared for throughout your life.

For assistance with your estate planning needs, please contact Jotkus Law Group

How to cut estate tax?

Introduction: Reducing estate taxes and preserving wealth are essential goals for individuals and families looking to secure their financial future. A well-structured estate plan can play a crucial role in achieving these objectives. In this article, we'll explore the top strategies for reducing estate taxes and preserving your hard-earned wealth.

Strategies for Reducing Estate Taxes:

Maximize Lifetime Gifting: One strategy to reduce estate taxes is to maximize lifetime gifting. By gifting assets during your lifetime, you can transfer wealth to your heirs and reduce the taxable value of your estate. Keep in mind the annual gift tax exclusion limit set by the IRS.

Irrevocable Trusts:

Irrevocable trusts can provide a powerful tool for estate tax reduction. By transferring assets into an irrevocable trust, you effectively remove them from your taxable estate, potentially reducing the overall tax liability.

Charitable Giving:

Charitable giving not only benefits the causes you care about but can also help reduce estate taxes. By donating to qualified charities, you may be eligible for tax deductions while supporting important charitable purpose.

Family Limited Partnerships:

Family limited partnerships can be utilized to transfer assets to family members while retaining control. By establishing a partnership, you can take advantage of valuation discounts, reducing the taxable value of your estate.

Utilize Life Insurance:

Life insurance can be used as a tool to provide liquidity for estate taxes. By strategically incorporating life insurance policies into your estate plan, you can ensure that your heirs have the necessary funds to pay estate taxes without having to sell valuable assets. By implementing these practical strategies, you can effectively reduce estate taxes and preserve your wealth for future generations. Remember, every individual's situation is unique, and consulting with a qualified estate planning professional is crucial to ensure a tailored approach that aligns with your specific needs and goals.

For assistance with your estate planning needs, please contact Jotkus Law Group

What Are The Key Differences Between Wills and Trusts?

When it comes to planning for the future of your assets, ensuring the financial security of your loved ones, and making decisions about how your estate will be managed after your passing, there are several legal tools you can use. Two of the most common tools are wills and trusts. In this article, we will delve into the differences between wills, and trusts, shedding light on their distinct purposes, advantages, and the roles of attorneys in the process.

Nature and Purpose:

An estate plan is a comprehensive strategy that encompasses various legal documents to manage your assets, health care preferences, and other aspects both during your lifetime and after your passing. A will is a legal document that outlines your wishes for asset distribution upon your death. A trust, meanwhile, is a legal entity that holds and manages assets for the benefit of specified beneficiaries during your lifetime and beyond.

Distribution of Assets:

A will specifies how your assets will be distributed among your heirs upon your death. Conversely, a trust allows you to transfer assets during your lifetime to be managed and distributed by a designated trustee according to your instructions, while avoiding the probate process.

Probate Process:

A will generally goes through probate, a court-supervised process of validating the will and distributing assets. In contrast, assets held in a trust are not subject to probate, potentially expediting the distribution process and providing greater privacy for your estate matters.

Privacy and Confidentiality:

Wills are typically public documents once they go through probate, which means the details of your estate become a matter of public record. Trusts, on the other hand, offer greater privacy as they are not required to be made public.

Flexibility and Control:

With a trust, you have more control over how and when your assets are distributed to beneficiaries. This can be particularly useful when there are complex family dynamics, minor beneficiaries, or individuals with special needs.

Legal Representation.

Seeking legal counsel is highly recommended for a proper estate planning to ensure legal requirements are met and documents are drafted correctly to avoid potential issues.

Types and Complexity:

Estate plans can include wills, trusts, healthcare directives, powers of attorney, and more. Trusts come in various forms such as revocable living trusts, irrevocable trusts, and special needs trusts, each serving different purposes and complexities.

Incapacity Planning:

An estate plan often includes documents like a durable power of attorney and advance healthcare directive, which designate individuals to make financial and medical decisions on your behalf in case you become incapacitated. Trusts can also include provisions for management of your assets in case of incapacity.

Conclusion:

In the realm of estate planning, the collaboration between individuals and legal professionals is pivotal. While a will and trust serve different functions within an estate plan, they both play a critical role in safeguarding your assets and ensuring your wishes are honored. Consulting with legal experts can help you make informed decisions tailored to your specific circumstances, providing peace of mind for you and your loved ones.

For assistance with your estate planning needs, please contact Jotkus Law Group

How to Choose an Estate Planning Attorney?

Key Factors to Consider:

Creating a comprehensive estate plan is a crucial step in ensuring your assets are protected and distributed according to your wishes after your passing. To navigate this complex legal process, it's essential to partner with an experienced estate planning attorney who can guide you through the intricacies of wills, trusts, and other crucial elements of an estate plan. In this article, we'll explore the key factors to consider when selecting an estate planning attorney.

1. Expertise and Specialization

When choosing an estate planning attorney, it's important to opt for someone with expertise and specialization in this specific field of law. Estate planning involves intricate legal mechanisms such as wills, trusts, powers of attorney, and more. Look for an attorney who has a demonstrated track record of dealing with these components and has the knowledge to tailor them to your unique situation.

2. Experience and Reputation

Experience often translates into expertise, so consider attorneys who have been practicing estate planning for a significant period. Research their background, read client testimonials, and seek recommendations from friends or family who have gone through the estate planning process. An attorney with a strong reputation is more likely to provide reliable and effective services.

3. Personalized Approach

Estate planning is not a one-size-fits-all process. A skilled estate planning attorney will take the time to understand your specific circumstances, family dynamics, and financial goals. They should be willing to create a customized estate plan that aligns with your wishes and provides for the future well-being of your loved ones.

4. Transparent Communication

Complex legal jargon can be overwhelming, so it's essential to find an attorney who can communicate clearly and effectively. A reputable estate planning attorney will explain the intricacies of wills, trusts, and other legal documents in a way that you can easily comprehend. Transparent communication ensures that you fully understand your estate plan and the decisions you're making.

5. Focus on Long-Term Goals

Estate planning isn't just about distributing assets; it's about ensuring the financial security of your beneficiaries in the long run. A skilled attorney will help you design a plan that considers potential tax implications, changing life circumstances, and the protection of your assets for generations to come.

6. Membership in Professional Associations

Membership in relevant professional associations, such as the American Academy of Estate Planning Attorneys, can indicate an attorney's commitment to staying updated on the latest legal developments and best practices in the field. This demonstrates their dedication to providing the highest level of service.

7. Accessibility and Availability

Estate planning is an ongoing process that may require adjustments over time. Choose an attorney who is accessible and available to address your concerns, answer your questions, and make necessary updates to your estate plan as circumstances change.

Conclusion:

Selecting the right estate planning attorney is a critical decision that can significantly impact the well-being of your loved ones and the execution of your wishes. By considering factors such as expertise, experience, personalization, communication, long-term focus, professional affiliations, and accessibility, you can make an informed choice that aligns with your estate planning needs. Remember, an effective estate planning attorney will guide you through the complexities of wills, trusts, and other legal components, providing you with peace of mind as you secure the future of your estate.

For assistance with your estate planning needs, please contact Jotkus Law Group

General Estate Planning FAQs

Estate planning is the legal process of preparing how your assets will be managed and distributed after your passing or if you become incapacitated. It ensures your property, savings, and investments go to the right people while minimizing taxes, court involvement, and potential disputes. Without an estate plan, state laws determine asset distribution, which may not align with your wishes.

: Having an estate plan prevents legal conflicts and safeguards your family’s future.

Start your estate plan today

The first step in estate planning is identifying your goals and gathering financial information. Follow these steps:

- List your assets (real estate, investments, bank accounts, etc.).

- Choose your beneficiaries (family, charities, organizations).

- Select key individuals (executor, trustee, guardians for children).

- Draft legal documents like a will, trust, power of attorney, and healthcare directive.

- Review and update your plan as your life changes.

: Estate planning is not only for the wealthy—everyone should have a plan.

Get expert guidance on estate planning

Estate planning is essential for anyone who owns assets, has dependents, or wants to ensure their wishes are followed. It’s particularly important for:

- Homeowners and investors who want smooth asset transfer.

- Parents who need to name legal guardians for children.

- Business owners looking for succession plans.

- Seniors preparing for Medicaid, long-term care, or wealth preservation.

: Without an estate plan, the courts decide how your assets are distributed.

Ensure your estate plan is up to date

A well-rounded estate plan includes:

- Last Will & Testament – Specifies asset distribution and guardians for minor children.

- Trusts – Helps avoid probate, manage wealth, and protect assets.

- Durable Power of Attorney – Appoints someone to handle financial matters if you become incapacitated.

- Healthcare Directive (Living Will) – States your medical wishes if you’re unable to communicate.

- HIPAA Authorization – Allows selected individuals access to your medical records.

: Having all these documents in place helps prevent costly legal battles.

Ensure your estate plan is complete

Working with an experienced estate planning attorney ensures your documents are legally valid and tailored to your situation. Attorneys help:

- Avoid costly mistakes that could lead to legal disputes.

- Maximize tax benefits and asset protection strategies.

- Ensure compliance with Illinois estate laws.

: A poorly written will can cause more harm than no will at all.

Ensure your estate plan is up to date

Avoiding these common estate planning mistakes can prevent legal complications:

- Not having an estate plan at all – State laws will control your estate if you don’t have one.

- Failing to update your will or trust – Major life events (marriage, divorce, new children) should trigger an update.

- Not naming backup beneficiaries – If a beneficiary passes away, it can create issues in distribution.

- Ignoring tax implications – Estate tax planning helps reduce the burden on your heirs.

- Not funding your trust – Setting up a trust is useless if assets are not transferred into it.

: Regularly reviewing and updating your estate plan ensures it remains effective.

Avoid estate planning mistakes—get professional help

It’s recommended to review your estate plan every 3-5 years or after major life changes, such as:

- Marriage or divorce

- Birth or adoption of children/grandchildren

- Buying or selling property

- Significant financial changes

- Death of a named beneficiary or executor

: An outdated estate plan can create legal disputes and unintended consequences.

Ensure your estate plan is up to date

Wills & Trusts FAQs

A will is a legal document that specifies how your assets should be distributed after your death. It must go through probate, which can be time-consuming and costly. A trust, on the other hand, allows assets to be transferred directly to beneficiaries, bypassing probate and offering privacy, flexibility, and tax benefits.

: A trust can provide faster asset distribution and better protection than a will alone.

Find out if a will or trust is right for you

In Illinois, a legally valid will must:

- Be created by a person who is at least 18 years old and mentally competent.

- Be in writing and signed by the testator (person making the will).

- Be witnessed by at least two individuals who are not beneficiaries.

- Clearly state how assets should be distributed and name an executor to manage the estate.

: A poorly written will can cause legal disputes and delays in asset distribution.

Ensure your will meets legal requirements

To minimize conflicts and prevent legal challenges, ensure that your will or trust:

- Clearly states who will inherit specific assets.

- Names a reliable and unbiased executor or trustee.

- Is regularly updated to reflect life changes.

- Includes a "No Contest" clause to discourage legal disputes.

- Is legally drafted and reviewed by an estate planning professional.

: Unclear or outdated estate documents can lead to unnecessary court battles.

Get help drafting a legally sound estate plan

The type of trust you need depends on your goals and financial situation:

- Revocable Living Trust – Allows you to manage assets during your lifetime and modify the trust as needed. Assets avoid probate but remain part of your taxable estate.

- Irrevocable Trust – Once created, it cannot be changed. It provides strong asset protection and reduces estate taxes.

: A revocable trust is best for flexibility, while an irrevocable trust is ideal for asset protection.

Determine the best trust for your needs

You can place a variety of assets in a trust, including:

- Real estate properties to avoid probate.

- Investment accounts & stocks for smooth transfer.

- Business interests to ensure continuity.

- Bank accounts & cash assets for direct access.

- Life insurance policies to protect beneficiaries.

: Assets left out of a trust may still go through probate.

Get expert advice on funding your trust

Yes, a will or trust can be contested in court under specific circumstances, such as:

- Allegations of fraud or undue influence.

- Claims of lack of mental capacity when the document was created.

- Improper execution, such as lack of witnesses or invalid signatures.

: Clearly written estate documents reduce the risk of legal challenges.

Ensure your estate plan is legally secure

A will or trust should be updated:

- Every 3-5 years or when significant life changes occur.

- If you experience marriage, divorce, or the birth of a child.

- If a beneficiary or executor passes away.

- If your financial situation changes (new property, investments, business interests).

: Regularly reviewing your estate plan ensures it stays aligned with your wishes.

Schedule an estate plan review today

If someone passes away without a will (intestate), their estate is distributed based on state intestacy laws, which typically:

- Give priority to a spouse and children.

- Pass assets to parents, siblings, or extended family if no spouse or children exist.

- In rare cases, assets go to the state if no heirs are found.

: Without a will, the court—not you—decides who inherits your assets.

Ensure your estate plan is in place

: Proper estate planning ensures a smooth transfer of assets without lengthy court involvement.

Discover ways to settle estates efficiently

Trust Administration & Fiduciary Services FAQs

A trustee is responsible for managing and distributing trust assets based on the terms outlined in the trust document. A trustee can be:

- A family member or friend chosen by the trust creator.

- A professional trustee or fiduciary who specializes in estate management.

- A corporate trustee (such as a bank or trust company) for complex estates.

: Choosing the right trustee ensures assets are handled responsibly and in the best interest of beneficiaries.

Need help selecting a trustee?

To fund a trust, you must formally transfer assets into it by:

- Retitling real estate in the trust’s name.

- Reassigning bank and investment accounts to the trust.

- Updating beneficiary designations on life insurance and retirement accounts.

- Transferring personal valuables (art, jewelry, vehicles) as per the trust terms.

: A trust without properly transferred assets may not protect your estate as intended.

Ensure your trust is fully funded

A trustee has a legal and ethical responsibility to manage the trust assets fairly and in the best interest of beneficiaries. Key duties include:

- Following trust instructions exactly as outlined.

- Investing and managing trust assets responsibly.

- Distributing assets to beneficiaries as directed.

- Keeping accurate financial records and reporting to beneficiaries.

: Failing to fulfill trustee duties can result in legal consequences.

Get legal guidance on trustee responsibilities

A trustee who fails to act in the best interests of the beneficiaries or mismanages trust assets can be:

- Held legally liable and removed by a court.

- Ordered to repay losses caused by mismanagement.

- Replaced with a new trustee chosen by the court or beneficiaries.

: Beneficiaries have the right to challenge a trustee who is not fulfilling their duties properly.

Learn how to remove or replace a trustee

Yes, a trustee can be removed if they:

- Fail to follow the trust terms or act dishonestly.

- Show incompetence in managing assets.

- Create conflicts of interest with beneficiaries.

- Are unable or unwilling to serve as trustee.

: A trust document may outline the process for removing or replacing a trustee.

Need to remove a trustee? Get legal advice

Trustees are legally required to maintain detailed financial records and report to beneficiaries. Professional help may be needed for:

- Preparing annual trust accountings and tax filings.

- Ensuring trust distributions comply with state and federal laws.

- Resolving disputes among beneficiaries regarding trust management.

: Failing to maintain proper trust accounting can result in legal penalties.

Speak with a trust compliance expert

If beneficiaries believe a trustee is mismanaging assets, they should:

- Request an accounting of trust transactions.

- Consult an attorney to review trust documents and legal options.

- File a petition to remove the trustee if misconduct is proven.

: Beneficiaries have the right to protect their inheritance from trustee mismanagement.

Take action if you suspect trust mismanagement

Asset Protection & Estate Tax Planning FAQs – Answers

Legal asset protection strategies help safeguard your wealth from lawsuits, creditors, and excessive taxation. Common strategies include:

- Setting up irrevocable trusts to protect assets from legal claims.

- Using business structures (LLCs, partnerships) to limit liability.

- Placing property in asset protection trusts to shield against creditors.

- Creating prenuptial and postnuptial agreements to protect personal assets in marriage.

: Without asset protection planning, your wealth may be at risk.

Secure your assets with expert guidance

Estate tax planning can help preserve more of your wealth for future generations. The best strategies include:

- Gifting assets to family members while minimizing tax liability.

- Using charitable trusts for tax benefits while supporting causes you care about.

- Setting up a family limited partnership (FLP) to manage assets efficiently.

- Leveraging the annual gift tax exclusion to transfer wealth tax-free.

: Proper estate tax planning can save your heirs thousands in taxes.

Learn how to reduce estate taxes legally

Business owners face unique financial risks that can be mitigated through:

- Creating an LLC or corporation to separate personal and business assets.

- Using liability insurance to protect against lawsuits.

- Establishing a buy-sell agreement to manage business succession smoothly.

- Holding business assets in a trust to prevent personal claims.

: Without asset protection, personal wealth could be at risk due to business liabilities.

Get professional advice on business asset protection

Legal Consultation & Advisory Services FAQs – Answers

You should consult an estate planning attorney when:

- Creating your first estate plan to ensure legal validity.

- Updating your will or trust due to marriage, divorce, children, or financial changes.

- Avoiding probate and simplifying asset transfer.

- Reducing estate taxes to maximize inheritance for your heirs.

- Setting up guardianship for minor children or elderly parents.

: The earlier you plan, the more options you have to protect your assets.

Schedule an estate planning consultation today

To make the most of your estate planning consultation, bring:

- A list of assets (real estate, investments, savings, retirement accounts).

- A list of beneficiaries (who will inherit your assets).

- Existing estate documents (wills, trusts, power of attorney, deeds).

- A list of financial obligations (loans, debts, tax liabilities).

- Any specific concerns about probate, taxes, or legal disputes.

: Being prepared for your consultation can save time and ensure an effective estate plan.

Get started with an estate planning consultation

The cost of estate planning varies depending on:

- The complexity of your estate (size of assets, number of beneficiaries).

- Whether you need a simple will or a complex trust structure.

- Additional legal services like probate avoidance or tax planning.

: A well-planned estate can save thousands in legal fees and taxes for your heirs.

Get a customized estate planning quote today

Estate planning isn’t a one-time process—it should be updated regularly to reflect life changes. Ongoing advisory services help:

- Ensure your plan remains up-to-date with new laws.

- Adjust for financial changes such as asset growth or new investments.

- Modify beneficiary designations as relationships evolve.

- Reduce estate taxes by implementing strategic financial moves over time.

: Regular estate plan reviews help prevent legal issues and ensure your wishes are honored.

Set up ongoing estate planning advisory services

Scheduling an estate planning consultation is simple:

- Choose a date and time that fits your schedule.

- Prepare your financial and asset information for discussion.

- Meet with an estate planning professional to discuss your needs.

- Receive tailored advice and next steps for your estate plan.

: A quick consultation can provide clarity and direction for your estate planning needs.

Book your estate planning consultation now

Yes! A well-structured estate plan helps avoid:

- Costly probate delays by ensuring assets transfer efficiently.

- Family disputes over inheritance rights.

- Unexpected tax burdens for your heirs.

- Legal challenges due to vague or outdated documents.

: Proactive estate planning can save your family from unnecessary legal stress.

Protect your assets and your family. Plan today.